GROWW, EDELWEISS, UNION, TATA — 4 MUTUAL FUND NFOs ARE NOW LIVE. FOR MORE DETAILS FOLLOW US ON INSTAGRAM AND FACEBOOK OR REACH OUT TO US DIRECTLY !!!!!!

*Subscription for the Edelweiss Financial Services is open from 05 Dec to 18 Dec. Understand features and risks before applying. Contact us if you want any information.*

*HCC AND PATEL ENGINEERING RIGHTS ISSUE BIDDING IS OPEN*

Our company was incorporated in 1996, by promoters, Mr. Dev Aswani, Mr. Narain Aswani and Mr. Mahesh Aswani.

Before the company came into existence, its promoters were engaged in brokerage business through a proprietary firm. Mr. Mahesh Aswani started the firm and offered services such as initial public offers and secondary market to its clients. The firm promoters were sub-brokers of the ASE and BSE.

There used to be a ring where saudas (transactions) took place through a OUT-CRY system. With the introduction of computerised transactions, many exchanges lost their trade volumes which resulted in closure of many of such stock exchanges including the ASEL. However, SEBI permitted extinguishing exchanges to form its subsidiaries and allow their members to trade through market platforms such as the BSE and NSE of India. Such an arrangement allowed HFPL to be affiliated to ASE Capital Market Ltd. (subsidiary of ASEL) and continue serving to its huge client base.

The Company is a Trading Member of NSE, BSE and Depository Participant of CDSL.

The company has large number of individual and corporate clients. The company has three branches spread across the city and is planning for more branches in the nearby future.

The company also received best businessman award from All India Sindhi Chamber of Commerce and Industry.

Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge.

Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month.

2. Mandatory details for filing complaints on SCORES Name, PAN, Address, Mobile Number, E-mail ID.

3. Benefits

Effective Communication

Speedy redressal of the grievances

BSE: 6374

NSE: 90384

CDSL: IN-DP-184-2016

SEBI REGISTRATION: INZ000203537

1006, B-wing, Atma house, Opposite Times of India, Ashram road, Ahmedabad 380009

An equity derivative is a class of derivatives whose value is at least partly derived from one or more underlying equity securities. Options and futures are by far the most common equity derivatives, however there are many other types of equity derivatives that are actively traded.

Commodity derivatives are investment tools that allow investors to profit from certain commodities without possessing them. The buyer of a derivatives contract buys the right to exchange a commodity for a certain price at a future date. The buyer may be buying or selling the commodity.

A mutual fund is a pool of money managed by a professional Fund Manager. It is a trust that collects money from a number of investors who share a common investment objective and invests the same in equities, bonds, money market instruments and/or other securities.

A bond is a type of security under which the issuer owes the holder a debt, and is obliged – depending on the terms – to repay the principal of the bond at the maturity date as well as interest over a specified amount of time. Interest is usually payable at fixed intervals.

A fixed deposit is a financial instrument provided by banks or NBFCs which provides investors a higher rate of interest than a regular savings account, until the given maturity date. It may or may not require the creation of a separate account.

An initial public offering or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail investors. An IPO is typically underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges.

| Headline | Link |

|---|---|

| CDSL – TRANSMISSION FORM ANNEXURE 7.1 | download |

| Account Closure Request Form | download |

| Modification Form Trading & Demat account | download |

| KYC (For Individuals Only) | download |

| KYC (For Non- Individuals Only) | download |

| DIS BOOK CANCELLATION | download |

| DDPI | download |

| Nomination Form | download |

| Redemption Form For Demat Mutual Fund | download |

| Account Opening Form(Individual) | download |

| Account Opening Form (HUF) | download |

| Pledge Request Form (2025) | download |

| Nominee Opt Out Form | download |

| Segment Modification Form | download |

| Headline | Link |

|---|---|

| Guidance Note - Do's and Don'ts For the Clients | download |

| Advisory For Investors | download |

| Risk-Disclosure-Document-in-English | download |

| Rights-and-Obligations-of-Stock-Broker-in-Gujarati | download |

| Risk-Disclosure-Document-in-Gujarati | download |

| Rights-and-Obligations-of-Stock-Broker-in-English | download |

| Do’s AND DON’TS english | download |

| Guidance-Note-DOS-and-DONTS-in-Gujarati | download |

| Dormant/Inactive Policy | download |

| Most Important Terms and Conditions (MITC) | download |

| Stop_Trade_Policy_2024 BSE AND NSE | download |

| STOP TRADE POLICY MCX | download |

| Privacy Policy | download |

| Online Payment Policy | download |

| Rights and Obligations DP | download |

| Voluntary Freezing and Trade Block Policy | download |

If you have any query than please drop us a mail from below form.

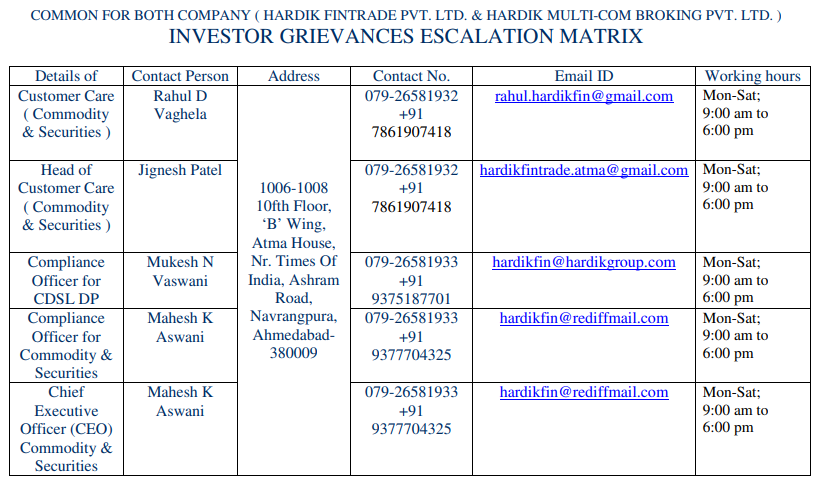

In absence of response/complaint is not addressed to your satisfaction, you may lodge a complaint with

SEBI,

NSE,

BSE,

CDSL, or

MCX.

Please quote your Service Ticket/Complaint Reference Number while raising your complaint on the SEBI SCORES or Exchange portal.